The Benefits of Cascading Payments and How Paymid Makes It Effortless

In the world of e-commerce and digital transactions, every failed payment represents lost revenue, frustrated customers, and potential cart abandonment. Enter cascading payments—a smart strategy that’s revolutionizing how merchants handle transactions. By automatically rerouting declined payments through alternative gateways or processors, cascading payments significantly boost acceptance ratios, ensuring more sales go through smoothly. In this blog post, we’ll dive into the key benefits of this approach, with a special focus on how Paymid, an AI-powered payment orchestration platform, enables merchants to implement it seamlessly while leveraging intelligent AI cascading to learn from past transactions and cut costs.

What Are Cascading Payments?

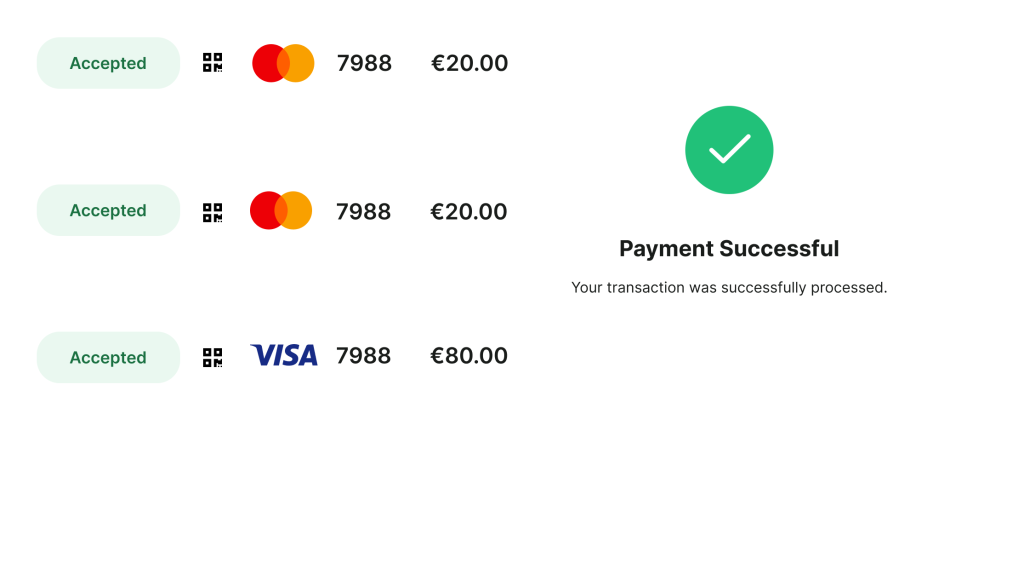

Cascading payments, also known as payment cascading or failover routing, involve setting up a sequence of payment processors or gateways. If the primary option declines a transaction—due to issues like network errors, issuer restrictions, or temporary outages—the system automatically “cascades” to the next available option without interrupting the customer experience. This smart routing ensures that payments have multiple chances to succeed, turning potential failures into approvals.

Unlike traditional single-gateway setups, cascading uses rules-based or intelligent logic to select the best path for each transaction, considering factors like geography, currency, and transaction type. This not only minimizes declines but also optimizes the overall payment flow for efficiency.

Key Benefits of Cascading Payments for Increasing Acceptance Ratios

The acceptance ratio—essentially the percentage of successful transactions out of all attempts—is a critical metric for any merchant. Low acceptance can stem from various uncontrollable factors, such as bank declines or gateway downtime. Cascading payments address this head-on, offering several compelling advantages:

1. Higher Transaction Success Rates

By providing backup options, cascading can improve approval rates by 10-20% or more, depending on the setup. Instead of a outright failure, the system retries through alternative channels, capturing revenue that would otherwise be lost. For high-volume businesses, this translates to thousands of additional successful transactions monthly.

2. Reduced Cart Abandonment and Better Customer Experience

Customers expect seamless checkouts. A declined payment often leads to abandonment, with studies showing abandonment rates as high as 70% in some sectors. Cascading keeps the process invisible to the user, maintaining trust and loyalty while reducing friction.

3. Revenue Growth and Cost Optimization

Beyond acceptance, cascading optimizes fees by routing to lower-cost providers when possible, potentially lowering processing costs. It also reduces churn by recovering failed payments automatically, boosting overall revenue without additional marketing efforts.

4. Resilience Against Downtime and Risks

Payment ecosystems are prone to outages. Cascading acts as a safety net, ensuring business continuity and protecting against single points of failure. This is especially vital for global merchants dealing with diverse regulations and networks.

In essence, cascading payments turn a reactive payment process into a proactive one, directly elevating acceptance ratios and driving sustainable growth.

How Paymid Enables Merchants to Implement Cascading Seamlessly

While the concept of cascading is powerful, implementing it can be complex—requiring integration with multiple gateways, real-time monitoring, and custom rules. This is where Paymid shines. As a cutting-edge payment orchestration platform, Paymid simplifies the entire process, allowing merchants to manage global payments through a single, centralized dashboard.

Paymid connects to over 600+ payment channels and processors worldwide, making it easy to set up cascading rules without deep technical expertise. Merchants can define sequences based on priorities like cost, speed, or success history, and the platform handles the routing automatically. This seamless integration means no more manual interventions or fragmented systems—everything flows through one API, reducing setup time and operational overhead.

For industries like e-commerce, iGaming, Forex, and CFD, Paymid’s flexible checkout and network of 600+ PSPs (Payment Service Providers) ensure tailored solutions that scale with business needs. Whether you’re a small startup or a large enterprise, Paymid’s automation turns cascading into a plug-and-play feature, helping merchants focus on growth rather than payment woes.

AI Cascading: Paymid’s Intelligent Edge for Learning and Cost Reduction

What sets Paymid apart is its AI-driven cascading, which goes beyond static rules to create a self-improving system. Using machine learning, Paymid analyzes historical transaction data—such as success rates, decline reasons, and patterns across regions, currencies, and customer behaviors—to dynamically optimize routing decisions.

How It Works:

- Learning from Past Transactions: The AI reviews outcomes from previous payments, identifying which gateways perform best under specific conditions. For instance, if a certain processor has higher success in Europe during peak hours, future transactions are routed accordingly.

- Real-Time Adaptation: Paymid’s system adapts on the fly, incorporating factors like transaction type and even fraud signals to minimize risks and maximize approvals.

- Cost Reduction: By prioritizing low-fee, high-success routes, AI cascading can slash processing costs by up to 15-20% over time, as the platform continually refines its logic based on data.

This intelligent approach not only boosts acceptance ratios but also evolves with your business, turning data into a competitive advantage. Merchants using Paymid report higher conversion rates and lower operational costs, all powered by AI that gets smarter with every transaction.

Conclusion: Embrace Cascading for a Future-Proof Payment Strategy

Cascading payments are more than a backup plan—they’re a strategic tool for enhancing acceptance ratios, delighting customers, and optimizing costs in an increasingly digital economy. With platforms like Paymid leading the charge through seamless integration and AI-powered intelligence, merchants can effortlessly harness this technology to stay ahead.

If you’re ready to reduce declines and supercharge your revenue, exploring Paymid’s orchestration features is a great next step.