Alternatives to PaymentIQ for Gaming Operators in 2025

In the rapidly evolving world of online gaming and gambling, payment processing is the backbone of seamless operations. Merchants and operators rely on robust platforms to handle transactions efficiently, ensure compliance, and maximize revenue. However, recent developments have shaken the industry. As of mid-2025, numerous gaming operators have received termination notices from PaymentIQ, a prominent payment orchestration platform owned by Worldline (formerly integrated with Bambora). These notices cite regulatory pressures, risk assessments, and strategic shifts away from high-risk sectors like online gambling. Worldline’s stock has plummeted amid allegations of facilitating “dirty payments” for high-risk merchants, including those in the gaming space, leading to a broader divestment strategy. This has left many operators scrambling for reliable alternatives that can maintain service continuity without compromising on features.

Enter Paymid, a cutting-edge payment orchestration platform that’s stepping up to welcome these displaced operators with open arms. Unlike PaymentIQ’s abrupt pullback, Paymid is actively positioning itself as a gaming-friendly solution, offering similar capabilities in routing, cascading payments, customer classifications, and automations—plus an innovative layer of AI-driven insights that boost transaction acceptance rates and enhance user experiences. In this comprehensive blog post, we’ll dive deep into the context of PaymentIQ’s changes, explore viable alternatives (with a strong focus on Paymid), and provide actionable insights for gaming operators looking to future-proof their payment ecosystems. By the end, you’ll understand why Paymid isn’t just an alternative—it’s a superior evolution for the industry.

Understanding PaymentIQ: A Brief Background

PaymentIQ has long been a go-to solution for merchants in various sectors, including e-commerce, fintech, and online gaming. Acquired by Bambora and later integrated into Worldline, a global payments giant, PaymentIQ specializes in payment orchestration. This means it acts as a central hub that intelligently routes transactions across multiple payment service providers (PSPs), gateways, and acquirers to optimize success rates and reduce costs.

Key features of PaymentIQ include:

- Intelligent Routing: Transactions are directed to the most suitable PSP based on factors like geography, card type, and historical performance.

- Cascading Payments: If one PSP fails, the system automatically tries alternatives in a predefined sequence, minimizing declines.

- Customer Classifications: Advanced segmentation allows operators to categorize users by risk level, behavior, or preferences, enabling tailored payment flows.

- Automations: Rule-based engines automate fraud detection, retries, and compliance checks, streamlining operations.

For gaming operators, these features have been invaluable. The industry faces unique challenges: high transaction volumes, regulatory scrutiny, chargeback risks, and the need for multi-currency support. PaymentIQ’s platform supported over 500 payment methods globally, integrating seamlessly with popular gaming platforms and ensuring compliance with standards like PCI DSS and GDPR.

However, the landscape shifted dramatically in 2025. Worldline, facing regulatory heat and internal restructuring, began issuing termination notices to certain gaming operators. Reports indicate this stems from heightened scrutiny on “high-risk” industries, with allegations linking Worldline to illegal gambling sites and merchant shuffling to evade regulations. In July 2025, Worldline announced a strategic divestment of parts of its business, signaling a pivot away from volatile sectors. This has affected hundreds of operators, particularly in Europe and emerging markets, forcing them to seek alternatives quickly to avoid downtime that could cost millions in lost revenue.

The gaming industry isn’t new to such disruptions. With global online gambling revenues projected to exceed $100 billion in 2025, operators need partners that are not only technically adept but also committed long-term. PaymentIQ’s exit highlights the fragility of relying on traditional providers amid evolving regulations, such as the UK’s Gambling Commission updates and EU anti-money laundering directives.

The Industry Impact: Why Operators Need Alternatives Now

The termination notices from PaymentIQ aren’t isolated incidents. They reflect broader trends in the payments ecosystem. Regulators worldwide are cracking down on gambling-related transactions, with Mastercard and Visa implicated in processing for unlicensed sites. This has led to increased compliance costs and risk aversion among legacy providers like Worldline.

For gaming operators, the fallout is multifaceted:

- Operational Disruptions: Sudden service halts can lead to failed deposits/withdrawals, eroding player trust.

- Revenue Losses: Declined transactions in gaming can reach 20-30%, amplified without robust orchestration.

- Compliance Burdens: Operators must ensure new providers meet local laws, such as KYC/AML in jurisdictions like the US, Canada, and Brazil.

- Innovation Gaps: Traditional platforms like PaymentIQ lack modern AI tools, leaving operators vulnerable to fraud and suboptimal acceptance rates.

Amid this turmoil, alternatives are emerging. While options like Adyen, Nuvei, and Paysafe offer solid foundations, they often fall short in gaming-specific customizations or AI enhancements. This is where Paymid shines, providing a seamless migration path with enhanced features tailored for gambling operators.

Exploring Alternatives to PaymentIQ

Before delving into Paymid, let’s survey the landscape. Based on industry analyses, here are top alternatives for online gaming payments in 2025:

| Alternative | Key Features | Strengths for Gaming | Limitations |

|---|---|---|---|

| Adyen | Unified global platform, fraud prevention, multi-currency support. | Handles high-volume transactions; integrates with major acquirers. | Less focus on cascading; higher fees for high-risk sectors. |

| Nuvei | Comprehensive PSP integration, risk management tools. | Popular in gambling; supports crypto and e-wallets. | Complex setup; occasional downtime in emerging markets. |

| Paysafe (Skrill/Neteller) | eWallets, prepaid cards, bank transfers. | Trusted in iGaming; fast payouts. | Limited routing intelligence; regulatory restrictions in some regions. |

| PayKings | High-risk merchant accounts, secure gateways. | Tailored for online casinos; reliable for US operators. | Basic automation; no advanced AI. |

These options provide varying degrees of similarity to PaymentIQ. For instance, Adyen excels in global scalability but lacks the deep automation for customer classifications that gaming operators crave. Nuvei and Paysafe are gaming staples, with Skrill being a preferred eWallet for bettors due to its VIP programs. However, none match Paymid’s blend of traditional orchestration with AI innovation, making it the standout choice for operators facing PaymentIQ’s exodus.

Spotlight on Paymid: The Future-Proof Alternative

Paymid is a next-generation payment operations and orchestration platform designed to empower merchants in high-stakes industries like online gaming. Founded with a focus on AI-driven efficiency, Paymid integrates over 500 payment channels through a single, centralized dashboard. Unlike PaymentIQ’s more rigid structure, Paymid welcomes gaming operators explicitly, offering a migration program that includes dedicated support for those affected by Worldline’s terminations.

At its core, Paymid mirrors PaymentIQ’s strengths while elevating them:

- Routing Capabilities: Paymid’s intelligent routing engine uses machine learning to select optimal paths in real-time. For gaming, this means routing deposits to PSPs with the highest success rates for specific regions—e.g., prioritizing local acquirers in Brazil for PIX payments or in Europe for SEPA transfers. This reduces latency and boosts conversions by up to 15%.

- Cascading of Payments: Similar to PaymentIQ, Paymid employs cascading logic, but with AI enhancements. If a transaction fails due to a soft decline (e.g., insufficient funds), the system not only retries via alternatives but also learns from patterns to prevent future issues. In gambling, where players often use multiple cards, this minimizes friction during peak betting hours.

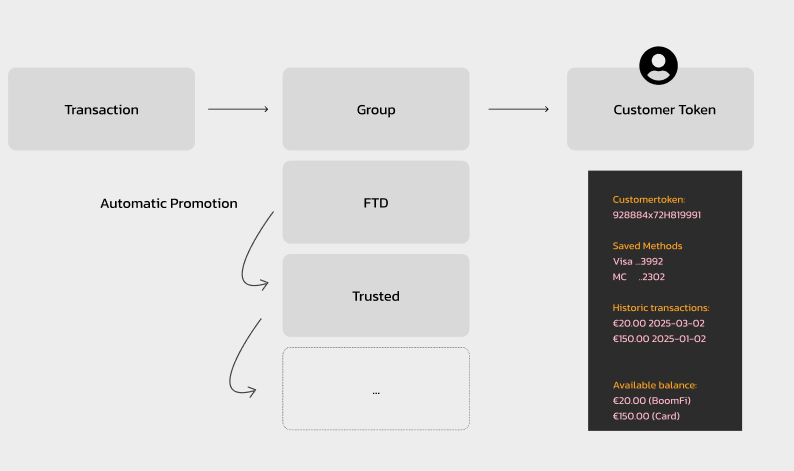

- Customer Classifications: Paymid excels here with granular segmentation. Operators can classify users based on deposit history, device type, geolocation, and even behavioral signals like session length. High-value VIPs might get premium routing to low-fee providers, while new users undergo enhanced KYC. This personalization aligns with gaming regulations, reducing chargebacks by classifying risky behaviors early.

- Automations: Rule-based and AI-augmented automations handle everything from fraud scoring to retry scheduling. For example, automated dunning for failed withdrawals or compliance checks for age-restricted gaming. Paymid’s platform integrates with CRM systems, allowing automations that trigger bonuses for successful deposits.

What sets Paymid apart is its AI insights layer, a feature absent in PaymentIQ and most alternatives. Paymid leverages artificial intelligence to analyze transaction data, providing actionable intelligence that helps operators increase acceptance ratios and create seamless experiences.

How Paymid’s AI Empowers Gambling Operators

In the gambling sector, acceptance ratios—the percentage of successful transactions—directly impact revenue. Industry averages hover around 85-90%, but declines due to fraud, issuer policies, or network issues can erode profits. Paymid’s AI addresses this head-on:

- Predictive Analytics: By processing historical data, AI forecasts decline risks. For instance, if a player’s card from a certain bank has a 20% failure rate during evenings, Paymid suggests alternative methods like eWallets proactively.

- Fraud Detection and Prevention: Advanced machine learning models detect anomalies in real-time, such as unusual betting patterns or multi-accounting. This is crucial for gaming, where bonus abuse is rampant. Paymid’s fraud management tools integrate with external databases, reducing false positives and ensuring compliance without alienating legitimate players.

- Optimization Insights: Real-time dashboards offer insights like “Transaction volume from UK players spikes 30% on weekends—optimize routing to Visa for faster approvals.” Operators can use this to refine strategies, increasing acceptance by 10-20% over time.

- Player Experience Enhancements: AI personalizes the payment journey. For example, recommending preferred methods based on past behavior or automating refunds for disputed bets. This leads to higher retention, as seamless payments correlate with longer player lifetimes.

A hypothetical case study illustrates this: A mid-sized online casino operator, previously on PaymentIQ, faced 25% declines during Euro 2024 due to cascading failures. Switching to Paymid, they implemented AI routing, which analyzed 1 million transactions to identify optimal cascades. Result? Acceptance jumped to 95%, adding €500,000 in monthly revenue. Additionally, AI flagged 15% more fraudulent attempts, saving on chargeback fees.

*Automatic promotion of customer groups.

Comparing Paymid to PaymentIQ: A Side-by-Side Analysis

To highlight Paymid’s advantages, consider this comparison:

| Feature | PaymentIQ | Paymid |

|---|---|---|

| Routing | Rule-based, multi-PSP | AI-enhanced, predictive |

| Cascading | Sequential retries | Intelligent, learning-based |

| Classifications | Basic segmentation | Behavioral AI classification |

| Automations | Rule engines | AI-automated with insights |

| AI Insights | None | Comprehensive analytics for acceptance boost |

| Gaming Focus | Diminishing (terminations) | Dedicated, welcoming high-risk |

| Integration Channels | 500+ | 500+ including crypto |

| Cost Efficiency | Standard fees | AI-optimized for lower declines |

Paymid not only replicates but surpasses PaymentIQ, especially in AI-driven value-adds that directly translate to ROI for gambling operators.

Benefits of Switching to Paymid for Gambling Operators

Transitioning from PaymentIQ to Paymid offers tangible benefits:

- Increased Acceptance Ratios: AI insights can lift rates by 10-25%, crucial for gaming where every deposit counts.

- Cost Savings: Reduced declines mean fewer lost sales and lower retry fees. Paymid’s orchestration minimizes per-transaction costs through efficient routing.

- Enhanced Security and Compliance: With built-in fraud tools and regulatory reporting, operators stay ahead of audits.

- Scalability: As gaming expands into markets like Africa and Asia, Paymid’s global channels support growth without reconfiguration.

- Seamless Migration: Paymid offers white-glove service for ex-PaymentIQ users, including data transfers and dedicated 24/7 support.

Real-world examples abound. In the online casino space, Paymid has transformed orchestration by providing real-time insights that optimize operations and manage fraud effectively. Operators report smoother experiences, with players appreciating faster, frictionless payments.

Moreover, in an era where AI is revolutionizing industries—like detecting fraud in betting platforms—Paymid positions gaming operators at the forefront. Unlike static alternatives, Paymid evolves with data, ensuring long-term resilience.

Conclusion: Embrace the Paymid Advantage

The termination of services by PaymentIQ marks a pivotal moment for gaming operators, but it’s also an opportunity to upgrade. While alternatives like Adyen and Nuvei provide stability, Paymid emerges as the premier choice—offering comparable routing, cascading, classifications, and automations, augmented by AI insights that elevate acceptance ratios and user experiences.

If you’re a gaming operator reeling from Worldline’s notices, Paymid welcomes you with tailored solutions that not only replace but enhance your payment infrastructure. Contact us today to explore migration options and start optimizing your transactions today. In a industry where every second and cent matters, choosing Paymid isn’t just smart—it’s essential for thriving in 2025 and beyond.