Guide to Payment Tokenization & Card Security

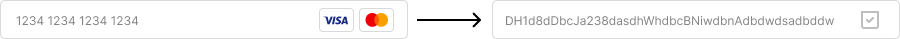

Payment tokenization transforms sensitive data, like primary account numbers (PAN), into a unique string of numbers referred to as tokens, which significantly enhances data security and PCI DSS compliance in payment processing 1. These tokens are designed for use in specific domains and payment environments, effectively minimizing the risk of fraudulent activities and promoting secure transactions for both businesses and consumers 1.

By adopting payment tokenization, businesses, especially those operating on subscription-based models or with repeat customers, can facilitate encrypted data transactions, thereby enabling streamlined, secure recurring payments and one-click or zero-click payments 1. Moreover, tokenization not only ensures compliance with PCI DSS but also plays a crucial role in reducing fraud and chargebacks, thereby protecting both the business and its customers 1.

Read More:

- Mastering B2B Payment Optimization [Expert Tips]

- How To Navigate Payment Compliance Regulations in 2024

- How To Optimize SaaS Payment Processing For Maximum Efficiency

- Merchant Acquirer vs Payment Processor: A Detailed Comparison

Understanding Credit Card Tokenization

Credit card tokenization is a crucial security measure that transforms a cardholder’s Primary Account Number (PAN) into a unique, randomly generated identifier known as a token. This process ensures that the cardholder’s sensitive data is not exposed during transactions, enhancing security across online platforms 3. Tokenization can be implemented in various forms, including network tokenization managed by card schemes, PCI tokenization by entities storing cardholder data, and digital wallet tokenization for secure mobile transactions 2.

Types of Tokenization

- Network Tokenization: Managed by payment service providers to secure data during transactions 2.

- PCI Tokenization: Used by merchants and payment processors to protect stored data 2.

- Digital Wallet Tokenization: Ensures the safety of data within digital wallets by replacing the PAN with a token on the user’s device 2.

Tokenization not only helps in securing the data but also aids businesses in achieving PCI DSS compliance, thereby protecting a wide range of payment technologies. It is especially beneficial in eCommerce and mobile wallets, enabling safe and personalized payment experiences 3. Moreover, tokenization is more cost-effective and secure compared to traditional encryption methods, making it a preferred choice for protecting sensitive information in digital transactions 5.

Tokenization vs. Encryption

Differences in Security and Application

Tokenization and encryption are both critical in safeguarding sensitive information but operate in fundamentally different ways. Tokenization replaces sensitive data with non-sensitive ‘tokens’ that have no intrinsic value, ensuring that the original data is securely stored in a separate database 7. This method is particularly effective for structured data fields such as payment card numbers, where the original data never leaves the organization, thus satisfying certain compliance requirements 8. On the other hand, encryption converts plain text into unreadable cipher text using a specific algorithm and key, making it ideal for securing both structured and unstructured data, such as entire files and server databases [7][9][10].

Scalability and Performance Challenges

While tokenization is heralded for its security benefits, it faces challenges in scalability and performance as the database size increases 8. Encryption, however, can scale to large data volumes efficiently using just a small encryption key to decrypt data, which is advantageous for large-scale applications [8][10]. Nevertheless, encrypted data requires a key or multiple keys for decryption, which poses a vulnerability if the keys are accessed by unauthorized parties 10.

Complementary Roles in Data Protection

Despite their differences, tokenization and encryption often work together to provide comprehensive protection against data theft at different stages of the payment stream 11. Encryption is extensively used for server databases and internet traffic, with the majority of websites employing this method to secure data exchanges with third parties and validate online identities 10. Conversely, tokenization is predominantly utilized by merchants and payment processors to comply with cybersecurity regulations and protect sensitive data such as credit card numbers and Social Security numbers 10. Together, they form a robust defense against data breaches and unauthorized access.

Applications and Examples of Tokenization

Payment tokenization has become integral to modern payment systems, particularly in environments where security and convenience are paramount. For businesses that operate on a subscription model or manage ecommerce platforms, tokenization reduces friction at checkout and enhances security for recurring payments 2. This technology is also essential in card-not-present transactions, which include internet purchases and mobile payments, protecting cardholder data by replacing sensitive information like the Primary Account Number (PAN) with secure tokens 12.

In the realm of mobile payments, tokenization is not just a security feature but a necessity. Samsung Pay, for instance, utilizes a Digital PAN (DPAN) to safeguard users’ real credit card numbers, ensuring that these details are never exposed during transactions. This approach has set a standard in mobile payment security, with tokenization being considered almost mandatory for mobile payment applications to operate securely in the near future 9.

Tokenization is also widely used across various retail settings, including e-commerce retailers, subscription services, and brick-and-mortar stores. It plays a critical role in safeguarding payment data and minimizing the risk of data breaches or fraud. In B2B contexts, solutions like MineralTree’s SilverPay demonstrate the application of tokenization by generating a unique card number for each transaction, thereby mitigating the risk associated with payment fraud 14. This widespread adoption underscores the versatility and effectiveness of tokenization in enhancing payment security across different business models and transaction types [13][14].

Why Businesses Should Implement Tokenization

Tokenization significantly enhances security and compliance for businesses, especially those handling sensitive customer data like credit card information. By replacing sensitive data with unique identifiers or tokens, businesses minimize the risk of data breaches and ensure compliance with stringent standards such as PCI DSS. This process limits the exposure of sensitive information, which is crucial for maintaining customer trust and legal compliance [15][16].

Key Advantages of Tokenization

- Enhanced Security and Compliance: Tokenization provides an added layer of security, helping businesses meet PCI DSS requirements and protect customer data from unauthorized access 16.

- Support for Emerging Technologies: Adapting to new payment technologies is crucial for businesses to stay competitive. Tokenization supports various payment methods, including digital wallets and mobile payments, ensuring flexibility and security 16.

- Streamlined Data Management: Simplifying data management processes through tokenization can lead to significant cost savings and more efficient operations, particularly in handling large volumes of transactions 16.

Tokenization not only secures data but also optimizes operational efficiency. By automating transactions and integrating smart contracts, businesses can achieve faster processing times and reduced operational costs. This technology allows for real-time settlement of transactions, which is particularly beneficial in high-interest-rate environments where financial firms can save significantly [17][19]. Additionally, tokenization opens up new investment opportunities by making assets like real estate or fine art more accessible and tradable through fractional ownership 18. This democratization of investments can attract a broader global investor base, fostering innovation and economic growth 18.

Our Comments

The rapid expansion of tokenized payment transactions underscores the growing reliance on this technology for enhancing payment security and operational efficiency. The anticipated increase from 680 billion transactions in 2022 to an expected 1 trillion by 2026 highlights a significant trend in the financial sector 16. This surge can be attributed to the robust security features of tokenization, which not only protect sensitive data but also streamline the transaction process, making it quicker and more reliable for both businesses and consumers. As tokenization becomes more integrated into payment systems globally, its impact on the market dynamics of digital payments is poised to be substantial, driving innovations and new strategies in financial services 16.

FAQs

1. What exactly is payment tokenization?

Payment tokenization involves a series of six key steps: Initially, the cardholder initiates the payment by entering their card details. These details are then converted into a token that is sent to the merchant’s bank. Following this, the token is transmitted via the credit card network for authorization.

2. How do I tokenize my credit card for online use?

Tokenizing your card is straightforward and can be completed online in a few minutes:

- Step 1: Visit any e-commerce merchant’s website or application to start a purchase or payment transaction.

- Step 2: Select the card you wish to use.

- Step 3: Secure your card details.

- Step 4: Confirm the creation of the token.

- Step 5: Your card is now tokenized and ready for secure transactions.

3. Can you explain the fundamental concept of tokenization?

Tokenization is the process of creating a digital, unique, and anonymous representation of a real-world item. In the context of Web3 applications, this digital token operates on a typically private blockchain, enabling its use within specific protocols while maintaining security and privacy.

4. How do tokenized payments function?

In tokenized payments, the Primary Account Number (PAN) is replaced with a secure token during the transaction process. This substitution ensures that the PAN is not exposed during the transaction, significantly enhancing the security of the payment. The security measures in place make it nearly impossible for the token to be used fraudulently.

References

[1] – https://www.adyen.com/knowledge-hub/payment-tokenization-guide[2] – https://www.checkout.com/blog/payment-tokenization

[3] – https://staxpayments.com/blog/credit-card-tokenization-explained/

[4] – https://www.mastercard.us/content/mccom-admin/faq-category-admin/tokenization.html

[5] – https://squareup.com/us/en/the-bottom-line/managing-your-finances/what-does-tokenization-actually-mean

[6] – https://www.tidalcommerce.com/learn/what-is-payment-tokenization

[7] – https://www.spreedly.com/blog/tokenization-vs-encryption

[8] – https://www.skyhighsecurity.com/cybersecurity-defined/tokenization-vs-encryption.html

[9] – https://www.cryptomathic.com/news-events/blog/tokenization-and-securing-mobile-payments-apps

[10] – https://www.usnews.com/360-reviews/privacy/tokenization-vs-encryption

[11] – https://www.tokenex.com/blog/tokenization-vs-encryption/

[12] – https://utimaco.com/current-topics/blog/applications-of-tokenization-in-payment

[13] – https://stripe.com/resources/more/payment-tokenization-101

[14] – https://www.mineraltree.com/payment-tokenization-explained/

[15] – https://www.spreedly.com/blog/how-does-payment-tokenization-work

[16] – https://www.medicaleconomics.com/view/payment-tokenization-what-it-is-and-what-it-does-for-health-care

[17] – https://www.forbes.com/sites/forbesfinancecouncil/2023/01/10/5-game-changing-benefits-that-tokenization-delivers/

[18] – https://info.polymath.network/blog/introduction-to-tokenization-the-benefits-it-brings-and-how-it-works

[19] – https://www.mckinsey.com/featured-insights/mckinsey-explainers/what-is-tokenization