Streamlining Withdrawals, Payouts Made For Efficiency

In the high-stakes worlds of iGaming and Forex, getting money into customers’ hands quickly and securely isn’t just a nice perk—it’s what keeps them coming back. As a payment orchestrator, Paymid is redefining how withdrawals work, cutting through the red tape that frustrates users and merchants alike. Let’s explore how Paymid’s payout flow streamlines the process, keeps customers happy, and leverages some clever features to tackle pain points in these fast-moving industries.

Why Smooth Payouts Matter in iGaming and Forex

If you’re a player in an online casino or a trader in the Forex market, you know the drill: you want your money, and you want it now. In iGaming, nothing kills the buzz of a big win like waiting days for your payout to clear. Slow withdrawals lead to annoyed players, bad reviews, and lost business. Forex traders, dealing with split-second market shifts, need fast access to funds to seize opportunities or cover margins. A clunky payout process can mean missed trades and eroded trust.

Old-school systems often rely on manual checks, endless compliance hoops, or disjointed integrations that slow everything down. Paymid flips this on its head with a streamlined flow that automates the heavy lifting while meeting strict regulations like AML and KYC. The payoff? Players and traders get their funds faster, and merchants save time and money. Data shows that seamless withdrawals can boost customer retention by up to 30% in competitive markets like these.

Take iGaming: automated payouts let players cash out their poker winnings without waiting for a Monday morning approval. In Forex, instant multi-currency handling ensures traders don’t lose out on exchange rate swings. It’s a win-win that keeps everyone moving.

How Paymid’s Payout Flow Works

Paymid’s withdrawal process is built to be fast, flexible, and reliable. Here’s the gist of how it flows:

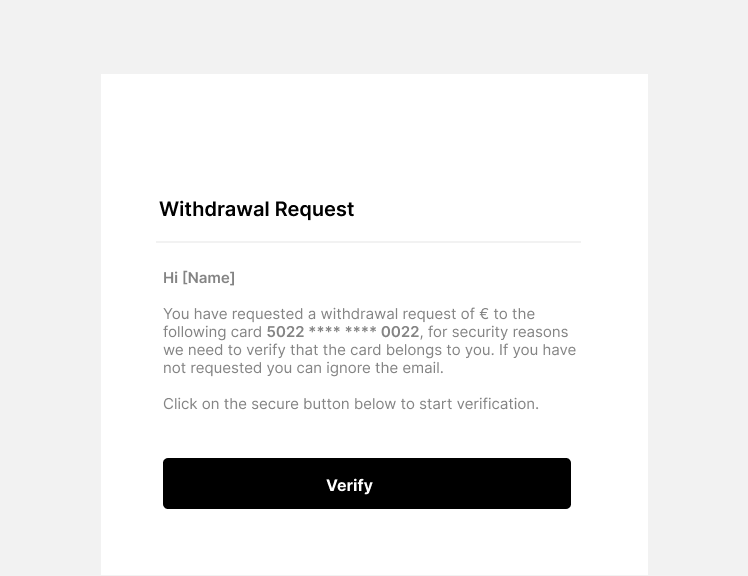

- Request Kicks Off: A customer submits a withdrawal through the merchant’s app or site, picking their preferred method—bank transfer, e-wallet, you name it.

- Smart Checks: Paymid automatically verifies the request against the user’s balance, transaction history, and compliance rules.

- Money Moves: Funds are sent through the best payment gateway, with options for instant or scheduled delivery.

- Closing the Loop: Users get a quick notification confirming the payout, so they’re never left wondering.

This isn’t a cookie-cutter setup. In iGaming, where bonuses and wagering rules complicate things, Paymid checks eligibility before greenlighting a payout. For Forex, it handles currency conversions on the fly, keeping costs low and payouts swift.

By automating these steps, Paymid cuts down on support tickets and manual work for merchants while giving customers a smooth, hassle-free experience.

Paymid’s Standout Features: Solving Real Problems

What makes Paymid a cut above are its unique tools designed to fix common payout headaches. These aren’t just fancy add-ons—they’re practical solutions that keep things secure, prevent misuse, and give merchants control without slowing down the process.

- Partial Refunds, Full Payouts: Sometimes, a customer’s balance isn’t fully available due to pending bonuses or trades. Paymid can release what’s ready now and queue up the rest for later. In iGaming, this means players aren’t stuck waiting for promotional credits to clear. In Forex, it keeps traders liquid even during volatile sessions, avoiding the frustration of rejected requests.

- Delayed Payouts for Protection: To stop users from gaming the system—like draining their balance right after requesting a withdrawal—Paymid lets merchants set a delay of a few hours. It’s a smart safeguard that gives time for reviews without holding up the whole process. In iGaming, it curbs bonus abuse; in Forex, it protects against shady trade tactics, all while running automatically.

- Instant Card Verification: Before any payout, Paymid checks credit or debit cards in real time for validity and fraud risks. This happens in seconds, cutting down on rejected requests and chargebacks—a big issue in Forex with international payments. Customers get their money faster, and merchants avoid costly disputes.

- Auto or Manual Approvals: Paymid offers flexibility. Low-risk payouts, like small casino winnings, can go through instantly with full automation. Bigger sums, like a Forex trader pulling out a hefty profit, can route to a manual queue for merchant review. This mix automates routine tasks—handling about 80% of requests without human input—while keeping high-stakes cases under control.

These features turn what could be a clunky process into something fast, secure, and user-friendly. iGaming merchants see fewer player complaints, while Forex platforms report better compliance and happier traders.

The Payoff: Happier Customers, Stronger Businesses

In a world where people expect instant results, Paymid’s payout flow delivers an experience that feels effortless. For iGaming and Forex, where every second counts, its blend of automation, smart verification, and flexible controls sets a new standard. Merchants save on operational costs, and customers stay loyal because they’re not stuck waiting or jumping through hoops.

If you’re running a business in iGaming, Forex, or any sector with frequent payouts, Paymid’s approach is worth a look. It’s not just about moving money—it’s about building trust and keeping users engaged. Curious about how Paymid can level up your withdrawal game? Check it out and see the difference.